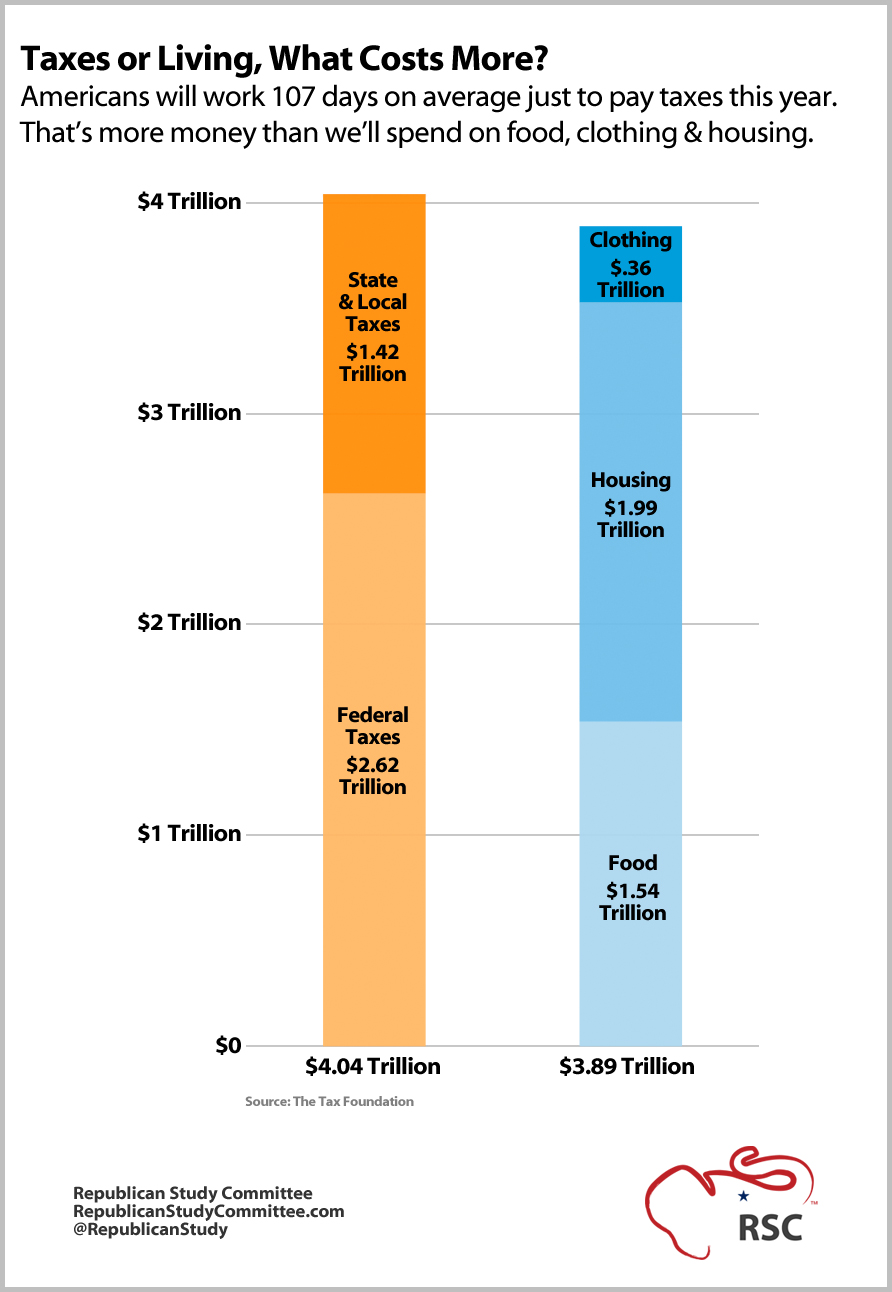

Today is tax day. By coincidence, it’s also Tax Freedom Day – the day Americans have finally earned enough to pay all our taxes for the year (but paying for all government spending would take a lot longer). According to the non-partisan Tax Foundation, the country will work 107 days this year just to pay for federal, state, and local taxes. By their calculations, a larger share of Americans’ income will go to taxes than food, clothing & housing combined!

Liberals like President Obama think we need even higher taxes and more complication. His latest ploy is the Buffett “Ruse,” which CNN reports “won’t do much to eat away at the nation’s debt, it won’t create jobs, and no one expects it to get through the Democratic-controlled Senate.” Personally, I don’t think it’s fair to make anyone give the IRS one-third of what they earn. Pile on state and local taxes, and you have a system that punishes success instead of rewarding hard work.

We need a tax code that encourages entrepreneurship and doesn’t make you work harder for the tax man than to put food on the table, clothes on your back, and a roof over your head. With just two rates, generous personal and dependent deductions, and no other complications, our proposal for an overhauled income tax keeps it simple, flat, and fair.

Liberal opposition from the White House and Senate means slim prospects for major tax reform, so the House will offer what help it can by voting this week to give small businesses a 20% tax cut. With our economy still in a fragile state, it’s the least we can do.

God Bless,

Congressman Jim Jordan

Chairman, Republican Study Committee